- #TURBOTAX 2017 HOME AND BUSINESS WILL NOT RUN FOR FREE#

- #TURBOTAX 2017 HOME AND BUSINESS WILL NOT RUN SOFTWARE#

This is called “netting” your food expenses. What this explanation is saying is if you received $4,000 from the Food Program and claim $5,000 in food expenses using the standard meal allowance, you should report zero income and $1,000 as a food expense. This explanation is extremely misleading and confusing. Enter the total amount on the next screen.” If you click on “Learn More” it says “If you are reimbursed for meals and snacks, you can deduct only the portion of the standard allowance that exceeds the reimbursement. It will then take you to the screen that says, “Standard Meal and Snacks Rates.” The rates for all states but Alaska and Hawaii are $1.31 breakfast, $2.46 lunch/dinner and $.73 snack. Use the 50% limit section if you are claiming food expenses for yourself at a conference or other business event away from your homeĪlways choose 100% Limit for food served to daycare children. TurboTax tells you to enter your food expenses under “Meals and Entertainment Expenses.” You are given two choices: Meals and Entertainment: 50% Limit or 100% Limit. See the Home Office Deductions section below. But, you will want to make sure that TurboTax is correctly calculating this for your house expenses. You can calculate your Time-Space Percentage on your own and apply this percentage before entering deductions into TurboTax. This is a big deal, so you want to make sure you understand the importance of entering the right numbers into TurboTax. If you spent $1,000 on supplies and your Time-Space Percentage is 35%, enter $350 into TurboTax. So, watch out! If you spent $100 on supplies that were used 100% for your business, enter $100 in TurboTax. This means you will have to apply your Time-Space Percentage that is calculated elsewhere (under Home Office Summary) on TurboTax. Since you will have many items that are used by your business and your family, you will need to multiply them by your Time-Space Percentage before entering them into the software. Unless you know you can deduct flashlight batteries, laundry detergent, light bulbs, tinfoil, window cleaner, toilet paper, and so on, you will miss out on a lot of deductions.Įxcept for house expenses and items you are depreciating, TurboTax will assume that any expense you enter is used 100% for your business.

#TURBOTAX 2017 HOME AND BUSINESS WILL NOT RUN SOFTWARE#

In other words, the software will ask you to enter your expenses for Supplies, but won’t tell you what you might include as supplies. TurboTax will not tell you what you are entitled to deduct as a business expense, other than identifying the categories of expenses as they appear on the tax forms.

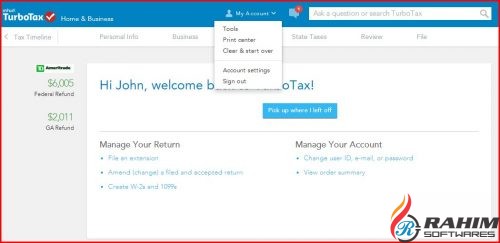

I will review H&R Block and TaxAct next week. (I reviewed the TurboTax Home & Business version for this article.) I’ve used TurboTax to do my own taxes for many years, so I want to point out a number of problems you can run into if you use it.

#TURBOTAX 2017 HOME AND BUSINESS WILL NOT RUN FOR FREE#

Note: The IRS has a program where you can use the TurboTax software, as well as other tax preparation software, for free if you are income eligible. The three major tax preparation software programs on the market are TurboTax, H&R Block and TaxAct Software. Not unless you know exactly what you are entitled to deduct as a business expense, how much of these expenses you can deduct, and where they should appear on your tax forms. Do I recommend that family child care providers use tax preparation software?

0 kommentar(er)

0 kommentar(er)